Taxation – MLA

Associated Courses

Course Description

Taxation (MLA) introduces you to the subject of taxation and provides the core knowledge of the underlying principles and major technical areas of taxation, as they affect the activities of individuals and businesses. Taxation (MLA) addresses the rationale behind – and the functions of – the tax system.

The syllabus then considers the separate taxes that an accountant would need to have a detailed knowledge of, such as income tax from self-employment, employment and investments; the corporate income tax liability of individual companies and groups of companies; the social security contribution liabilities of both employed and self-employed persons; the value added tax liability of businesses; and the tax liabilities arising on the disposal of capital assets by both individuals and companies.

Course Structure

On successful completion of this exam, you should be able to:

- Explain the operation and scope of the Maltese tax system and the obligations of taxpayers and/or their agents and the implications of non-compliance

- Explain and compute the income tax liabilities of individuals

- Explain and compute the corporate income tax liabilities of individual companies and groups of companies

- Explain and compute the tax liabilities arising on the disposal of capital assets by companies and individuals

- Explain and compute the effect of social security contributions on employees, employers and the self employed

- Explain and compute the effects of value added tax on incorporated and unincorporated businesses

- Demonstrate employability and technology skills

Should Attend

Individuals who are doing their ACCA Applied Skills exams

Prerequisites

Either has completed all 3 Applied Knowledge exams or hold a relevant Accounting, Finance, or similar degree

Assessment

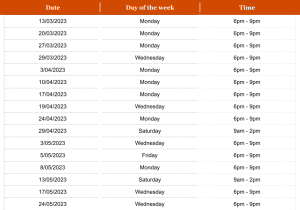

The Academy prepares students to sit for their Computer Based Exam (CBE) in either June or December.

Key-Features

- First class tutoring

- Option to attend in-person or online live

- Innovative materials

- Unique online learning

- Exam standard questions throughout

- Student support

- Mock exams

Course Structure

On successful completion of this exam, you should be able to:

- Explain the operation and scope of the Maltese tax system and the obligations of taxpayers and/or their agents and the implications of non-compliance

- Explain and compute the income tax liabilities of individuals

- Explain and compute the corporate income tax liabilities of individual companies and groups of companies

- Explain and compute the tax liabilities arising on the disposal of capital assets by companies and individuals

- Explain and compute the effect of social security contributions on employees, employers and the self employed

- Explain and compute the effects of value added tax on incorporated and unincorporated businesses

- Demonstrate employability and technology skills

Should Attend

Individuals who are doing their ACCA Applied Skills exams

Prerequisites

Either has completed all 3 Applied Knowledge exams or hold a relevant Accounting, Finance, or similar degree

Assessment

The Academy prepares students to sit for their Computer Based Exam (CBE) in either June or December.

Key-Features

- First class tutoring

- Option to attend in-person or online live

- Innovative materials

- Unique online learning

- Exam standard questions throughout

- Student support

- Mock exams

Register Your Interest: