Advanced Taxation – MLA

Associated Courses

Course Description

The Advanced Taxation – Malta (ATX-MLA) syllabus further develops the key aspects of taxation introduced in the compulsory Taxation – Malta (TX-MLA) syllabus within the Applied Skills module and extends the candidates’ knowledge of the tax system, together with their ability to apply that knowledge to the issues commonly encountered by individuals and businesses; such that successful candidates should have the ability to interpret and analyse the information provided and communicate the outcomes in a manner appropriate to the intended audience.

The syllabus builds on the basic knowledge of core taxes from the earlier taxation exam and introduces candidates to additional capital taxes (such as duty on documents and transfers) and tax incentives (such as those contemplated under the Malta Enterprise Act). As this is an optional exam, aimed at those requiring/desiring more than basic tax knowledge for their future professional lives, the syllabus also extends the knowledge of income tax to encompass further international aspects of taxation.

Section E of the syllabus contains outcomes relating to the demonstration of appropriate digital and employability skills in preparing for and taking the examination. This includes being able to access and open exhibits, requirements and response options from different sources and being able to use the relevant functionality and technology to prepare and present response options in a professional manner. These skills are specifically developed by practicing and preparing for the exam, using the learning support content for computer-based exams available via the practice platform and the ACCA website and will need to be demonstrated during the live exam.

Computations will normally only be required in support of explanations or advice and not in isolation. Candidates are not expected to concentrate on the computational aspects of taxation. Instead, this paper seeks to develop candidates’ skills of analysis, interpretation and communication. Candidates are expected to be able to use established tax planning methods and consider current issues in taxation.

Course Structure

On successful completion of this exam, you should be able to:

- Apply further knowledge and understanding of the Maltese tax system through the study of further taxes and tax incentives, together with more advanced topics within the taxes studied previously

- Identify and evaluate the impact of relevant taxes on various situations and courses of action, including the interaction of taxes

- Provide advice on minimising and/or deferring tax liabilities by the use of standard tax planning measures

- Communicate with clients, the Inland Revenue and value added tax (VAT) departments and other professionals in an appropriate manner

- Demonstrate employability and technology skills

Should Attend

Individuals who are doing their ACCA Strategic Professional exams

Prerequisites

Either has completed all 3 Applied Knowledge exams and all 6 Applied skills exams or hold a relevant Accounting, Finance, or similar degree

Assessment

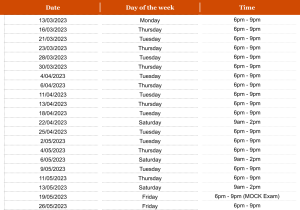

The Academy prepares students to sit for their Computer Based Exam (CBE) in either June or December.

Key-Features

- First class tutoring

- Option to attend in-person or online live

- Innovative materials

- Unique online learning

- Exam standard questions throughout

- Student support

- Mock exams

Course Structure

On successful completion of this exam, you should be able to:

- Apply further knowledge and understanding of the Maltese tax system through the study of further taxes and tax incentives, together with more advanced topics within the taxes studied previously

- Identify and evaluate the impact of relevant taxes on various situations and courses of action, including the interaction of taxes

- Provide advice on minimising and/or deferring tax liabilities by the use of standard tax planning measures

- Communicate with clients, the Inland Revenue and value added tax (VAT) departments and other professionals in an appropriate manner

- Demonstrate employability and technology skills

Should Attend

Individuals who are doing their ACCA Strategic Professional exams

Prerequisites

Either has completed all 3 Applied Knowledge exams and all 6 Applied skills exams or hold a relevant Accounting, Finance, or similar degree

Assessment

The Academy prepares students to sit for their Computer Based Exam (CBE) in either June or December.

Key-Features

- First class tutoring

- Option to attend in-person or online live

- Innovative materials

- Unique online learning

- Exam standard questions throughout

- Student support

- Mock exams

Register Your Interest: